We discussed the increased severity and frequency of recent wildfires in a previous post. Alaska, California, Oregon, Texas, and Utah have experienced more acres burned by wildfires in the past three years than any other state in the US. What’s more, AccuWeather estimates damages of roughly $90 billion in 2021 alone.

There’s no denying that wildfires heavily impact our lives. Business and commercial property owners alike must now safeguard their assets against potential wildfire damage — but even that’s getting more complicated. Let’s talk about the options you have regarding wildfire insurance and which plan fits your needs.

Understanding Traditional Wildfire Insurance

Traditional commercial insurance isn’t overly complicated; however, it is highly nuanced. It can also seem a bit stuck in the mud, dating back to colonial days. Even with an eclectic heritage, traditional insurance is often customizable and tailored to businesses’ unique needs. It’s not uncommon for commercial brokers to work diligently to find an affordable, well-fitting insurance plan for their business clients.

On the one hand, though, commercial policies sometimes come across as one-size-fits-all while others are so flexible that the coverage gaps are massive. Others still only base premiums on the following standard factors:

- Industry

- Number of employees

- Company type

- Geographic location

- Payroll

- Years in operation

- Risk exposure

- Claim history

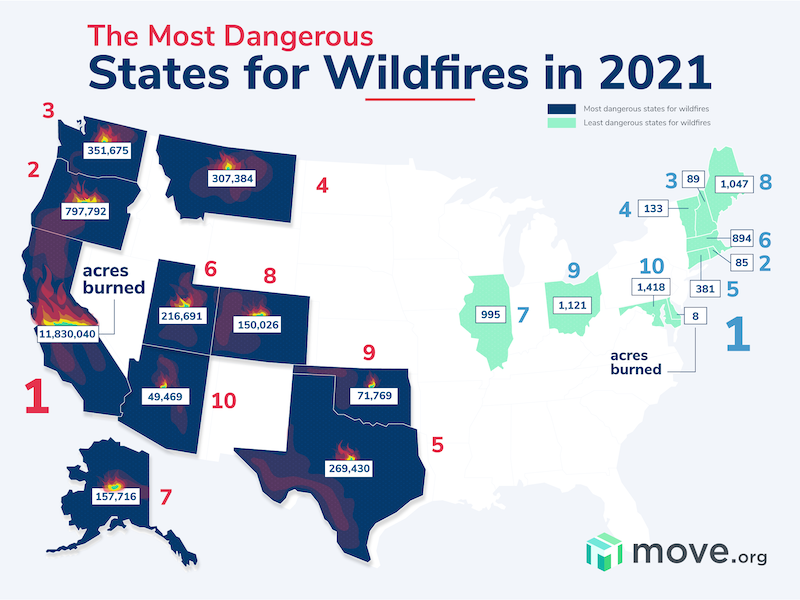

On the other hand, many businesses function successfully with traditional insurance as a wheelhouse. Navigating typical premiums, deductibles, policy limits, and exclusions suits them well. But what about the companies operating in high-risk areas, as the map below indicates?

Source: Move.org

While wildfires impact each state differently, it’s helpful to gain a broader understanding of which states carry more risks. According to Bankrate, the following US states are the riskiest for wildfires, and the corresponding numbers indicates the number of at-risk properties:

- California: 2,054,900

- Texas: 717,800

- Colorado: 373,900

- Arizona: 242,200

- Idaho: 175,000

Remember that businesses can suffer more damage from wildfires than merely property damage. Consider business interruption or business income risks if a wildfire halts regular operations. That said, many businesses in the West and Southwest US filed several claims during losses from the same wildfire this year, and it didn’t take long for those deductibles to add up and limits to reach capacity. These situations only prove that traditional wildfire insurance isn’t always the best fit for every business.

How the Current Market Creates Coverage Issues

Whether in the news or word of mouth, you’ve likely heard buzzwords like “class-action lawsuits” or the “hardening market.” The skinny on these insurance-related topics is that the market is currently hardening across many verticals.

But let’s back up to review the different types of markets: hard and soft. A soft market is characterized by steady or decreased premiums and more carrier capacity. We tend to experience increased rates and less carrier capacity in a hard market, and coverage might even be hard to come by.

The insurance market is cyclical, driven by waves of highs and lows — hence its nuanced nature mentioned earlier. Hard markets are nothing new; we’ve experienced this cycle in the late 70s, mid-80s, and early 2000s. Cultural movements, a global pandemic, governmental shifts, technological advances, and more impact market fluctuations.

Unfortunately, we’re currently experiencing a hardening market in our corner of the real estate world. We see less carrier capacity, higher deductibles, and increased premiums. Of course, the market will change again, but it’s creating coverage issues for commercial property owners for now.

Alternate Wildfire Insurance Options

Although traditional insurance plans work for many outside of the “hot” zones, consider the following insurance options if your business operates in a high-risk area.

The FAIR Plan (California)

California has famously been battling wildfires for ages. Homeowners and commercial property owners have faced loads of challenges purchasing traditional insurance. Mainly, carriers didn’t want the liability risk. As a result, the California FAIR Plan Association launched the FAIR Plan in 1968.

This plan is a syndicated fire insurance pool comprised of all (property & casualty) insurers licensed in California. Homeowners and business owners can purchase a FAIR Plan policy. Plus, the coverages include more than mere property, including business liability, business income, and extra expense coverage. Naturally, business owners must tailor the policy to their needs, and the additional policies might cost a little extra than a basic plan.

Parametric Insurance

Besides pooling wildfire risks, some insurance underwriters have taken an innovative approach. For example, Descartes Underwriting uses risk modeling techniques and advanced technology to safeguard against climate risk.

Instead of the onesie-twosie claim filing procedures of traditional insurance plans, they’ve taken an all-season approach. Descartes created an index of wildfire damage and value distribution across insured areas with satellite imagery and insightful weather data. They settle on a hectare’s value and equivalent indemnity from the season’s start. This strategy allows clients to know what they’ll receive if wildfires cause loss during the risk season. They also provide no “small wildfire” exclusions .

The Next Step

As commercial brokers, we strive to find the best solutions for our clients — even if that means forgoing traditional insurance plans. Admittedly, we’ve relied on the listed alternatives more than a few times. They’re excellent insurance options for commercial property owners that might otherwise come up empty-handed.

Plus, we encourage our partners to prepare for wildfires in the best way possible. We’ve even created a Step-by-Step Wildfire Preparedness Guide to help you get through this season unscathed.

If you’re interested in learning more about your commercial insurance options, please visit our Contact Us page. We’re here to help!