The Federal Emergency Management Agency (FEMA) has recently rolled out a new risk rating methodology for the National Flood Insurance Program (NFIP). In FEMA’s official press release, one of the main goals is to deliver more equitable pricing. But what does this mean for your property? In this post, we review these updates and how they’ll impact you in the future.

What Is Risk Rating 2.0?

Since the 1970s, FEMA has been rating areas in the United States according to how prone they are to flooding. These ratings dictate insurance coverage for residential and business property, in general, and how much an insurer should charge for premiums. A lot has changed in roughly fifty years, but FEMA’s system has largely remained the same.

Unfortunately, static measures and outdated methods have traditionally informed a Flood Insurance Rate Map (FIRM) zoning, focusing mainly on a property’s elevation. However, Risk Rating 2.0 aims to change all that.

FEMA has been gathering and investing in data for many years, including catastrophe models, informational hazard sets, and actuarial science. Only now can the agency put all the data to good use. Risk Rating 2.0 harnesses these new capabilities and tools to rate areas according to updated variables.

The new variables include flood frequency and type, distance to a water source, and specific property characteristics (i.e., materials, the cost to rebuild, etc.). It’s as close to real-time data as FEMA can get, and it’s more accurate than the previous system.

Why Did FEMA Change Systems?

It’s not breaking news that some policyholders have historically paid for more than their share of the risk while others have paid for less. In the past, though, FEMA didn’t have a better way to spread the risk more equitably. It’s not a guessing game, after all.

However, Risk Rating 2.0 factors in rebuilding costs, enabling FEMA to distribute premiums across the policyholder pool more equitably. This new method also allows a property’s value and unique flood risk to weigh premium costs.

Additionally, not even FEMA could turn a blind eye to the impact of COVID-19. The economic impact of the global pandemic, along with drastic climate change, devastated homeowners and businesses alike, motivating FEMA to take action sooner than later.

What Will Risk Rating 2.0 Change?

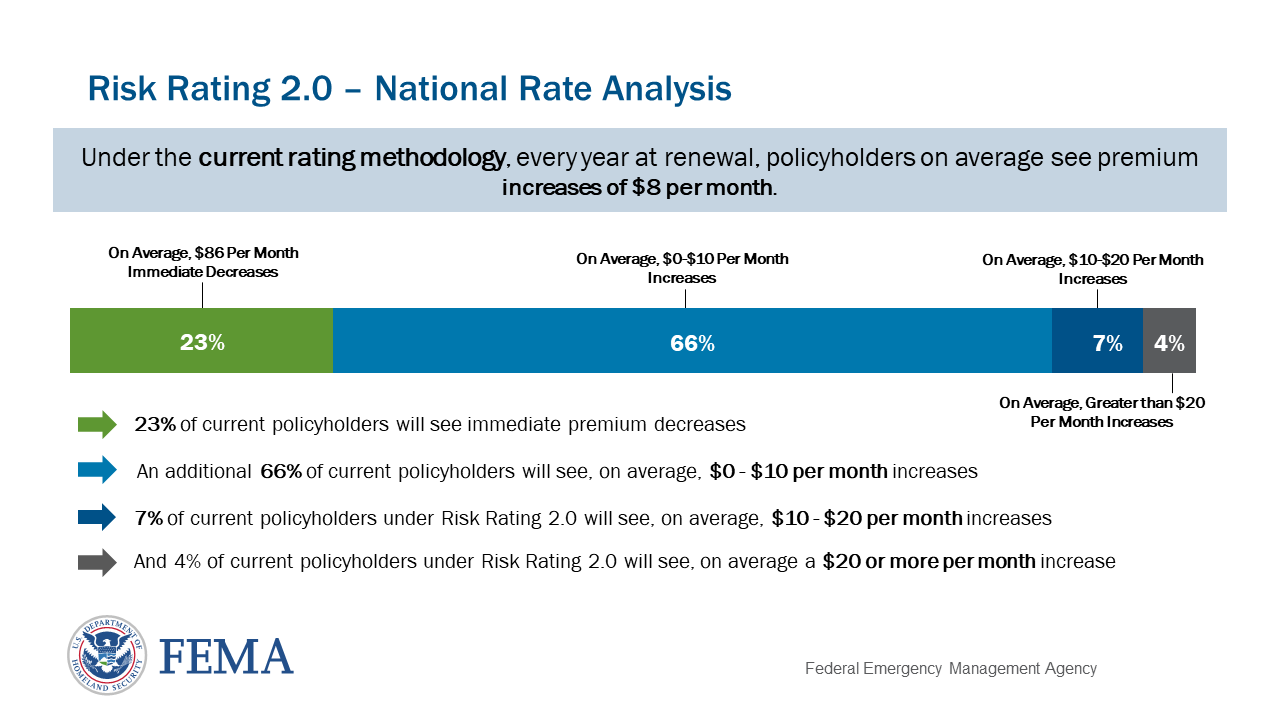

The most significant element Risk Rating 2.0 will change is the cost of premiums. As mentioned, this new rating system factors in more flood risk variables than the previous one, so FEMA can distribute premiums more equitably. Here’s a rate analysis overview for comparison:

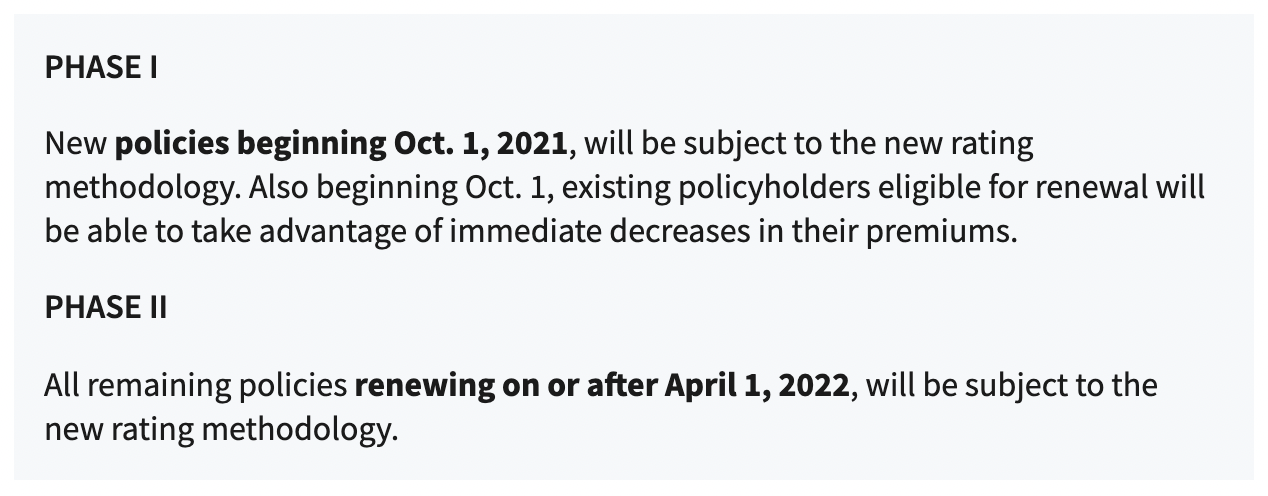

Policyholders paying for more than their share of premiums will experience decreased costs and vice versa. Furthermore, the new information and technological advances will enable FEMA to better predict flood damage in various areas of the country. Some policyholders are already experiencing the new rating system, as outlined in the phases below:

Source: FEMA.gov

What Will Stay the Same?

Although FEMA’s rating system overhaul is massive, some things will remain the same. For example, the agency will keep limiting premium increases to no more than 18% per year. Policyholders can rest easy knowing this cap is still in place, and they won’t receive an unexpected amount to pay.

Plus, FEMA will still use its traditional flood maps as guidelines for building and purchase requirements in a floodplain. FEMA will also continue to offer premium discounts to those policyholders who are eligible.

For quick reference, here’s a roundup of the items that will remain the same:

- Limit of 18% yearly premium increase

- Usage of FIRMs for mandatory purchases and floodplain management

- Premium discounts offered to eligible policyholders

How Can You Benefit From the New System?

No matter how grand, a new system rarely grabs anyone’s attention unless its benefits are easily attainable. Fortunately, FEMA’s new Risk Rating 2.0 can provide plenty of benefits for homeowners and commercial property owners alike.

Start by talking with your commercial insurance broker to learn more about where your business fits in the new rating system. Naturally, each policyholder presents a unique situation based on their location and particular variables. Once you discover your Risk Rating 2.0 placement, you can then begin to set new standards to get the most out of your property.

We encourage you to learn as much as you can about Risk Rating 2.0 and nurture an ongoing conversation with your commercial broker to get the most bang for your buck — especially as the real estate environment shifts and evolves.

***

If you’re interested in learning more about your commercial insurance options, please visit our Contact Us page. We’re here to help!