Insurance carriers often face challenges from incorrect multifamily property valuations due to outdated information about the properties. As the market has continued to harden throughout 2022, carriers have increased scrutiny of property valuations.

Data from SwissRe demonstrates the gap between insured and actual losses.

How does the insurance gap between insured and actual loss affect multifamily properties?

Natural disasters are rising and pose significant challenges to communities and property. Between climate change, a higher concentration of people in high-risk areas, and environmental devastation, the adverse effects of natural catastrophes will continue to grow. Unless addressed the protection gap, which can be defined as the difference between economic losses and insured losses resulting from catastrophes, will also increase.

Multifamily properties have seen double-digit rate increases for the insurance they carry. These increases are due to a gap in insurance coverage between previous replacement values and today’s sky-high costs to replace a seriously damaged property. This rate is even higher in catastrophe-exposed locations such as Florida.

Advanced risk modeling can help multifamily property owners see if they are in a primary or secondary peril area and then use the data to determine if they hold enough coverage if those perils hit. One of the most prevalent secondary perils is flooding. Floods have caused insured losses averaging about $11 billion a year over the past decade across the globe. New strategies, like advanced risk modeling and data insights, need to be used to address these growing risks and prevent insurance gaps.

Suppose a multifamily property is in a high-risk flood area. In that case, the owners need to evaluate their insurance coverage to ensure replacement costs are enough to rebuild if they experience an insurable loss. A significant problem with rebuilding is trying to estimate construction costs.

Construction costs have increased significantly due to the following:

- Pandemic and supply-chain issues

- Rising prices for building materials like lumber, copper, and asphalt shingles

- High labor costs

- Lack of workers, causing projects to take more time to complete

Real Estate focused insurance carriers need better risk models to evaluate the risk of a multifamily property they insure accurately. However, with this increased scrutiny, carriers will benefit from underwriting guidelines better adapted to the asset characteristics and location to create suitable insurance to value for multifamily properties.

Why are insurance prices rising for multifamily properties?

High cost of raw materials due to supply chain disruptions

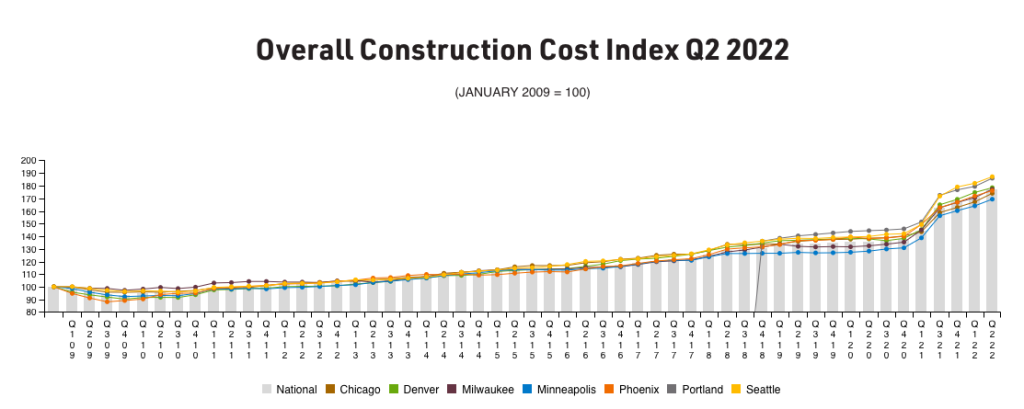

The graph below shows that some construction costs have increased by nearly 45% in the last ten years. With increasing construction costs, insurance companies can’t offer the same policy prices year after year and still keep up with proper insurance to value.

Inflationary pressure

Inflation has driven home replacement costs higher and increased insurance rates in all regions of the U.S. Inflation causes the cost of labor and materials to rise. Property rates in less risky areas have still increased by 5-10%; albeit in high-risk areas prone to natural disasters such as hurricanes, wildfires, hail, and windstorms, prices have increased by as much as 30%.

Catastrophic events

From 2017-2022, there have been a record number of natural disasters in the U.S. The National Oceanic and Atmospheric Administration states that in 2020 there were a record number of billion-dollar climate and weather disasters recorded. The damage from these catastrophic events totaled approximately $95 billion. The insurance industry paid $83 billion of those damages. These losses drive the higher rates that insurers are charging today.

What you can expect for insurance costs in 2022-2023

- Rate increases in the high-single digits to as much as 15% on accounts with no losses. This may be even higher on multifamily properties with losses or in high-risk areas.

- Increased deductibles and rates for damage caused by select catastrophes, like hurricanes and floods.

- On larger property portfolios ($100 million in value and up), to get full limits, getting insured will frequently require multiple insurance carriers to share in the risk.

How to control your insurance costs

Improve experience and pricing representation to amplify savings. Work with your insurance broker to drive a reduction in the primary layer of coverage; it will help control the excess insurance layers. This can be achieved through a risk transfer program.

Know your detailed claims loss history. Proactively address claims at the onset to achieve better outcomes. Through your insurance carrier, your claims advocate should be working with your compliance team and your tenant’s legal liability program to minimize risk.

Compare your insurance rate and coverages. Work with a broker with access to benchmarking and analytical tools and resources to set thresholds for risk. Have them compare their rates and coverages across multiple insurance companies.

Model ways to stabilize cash flow. Use catastrophe modeling and loss history analysis to project future hidden costs and plan for them. However, only certain brokers have access to these tools. Work with experienced brokers to explore ways to stabilize cash flow.

Reduce the impact of the renewal cycle. As rates continue to increase, evaluate non-traditional insurance solutions such as tenant legal liability and parametric insurance to drive net operating income at the asset level.

To get the proper insurance-to-value coverage for your multifamily property, partner with a team with a proven track record in navigating the hard market. An experienced team like ReShield & BKS Partners can help you analyze coverage complexities to arrive at the proper protection for your investments and assets.